Operating in a country globally renowned for its incredible natural beauty, game farms, wealth of adventure activities and much more, guesthouses and bed-and-breakfast establishments (B&Bs) are fortunate to have a steady stream of visitors to target year-round.

Periods such as long weekends, school holidays and public holidays are peak operating times. The returns can be phenomenal and, as a responsible operator wanting your guests to enjoy their long-awaited break, you will already have measures in place to minimise risk. But how do you make sure you have covered all your bases with adequate insurance?

Understand the cover you have

As a property owner, you will likely already have regular homeowner’s insurance, including personal liability cover.

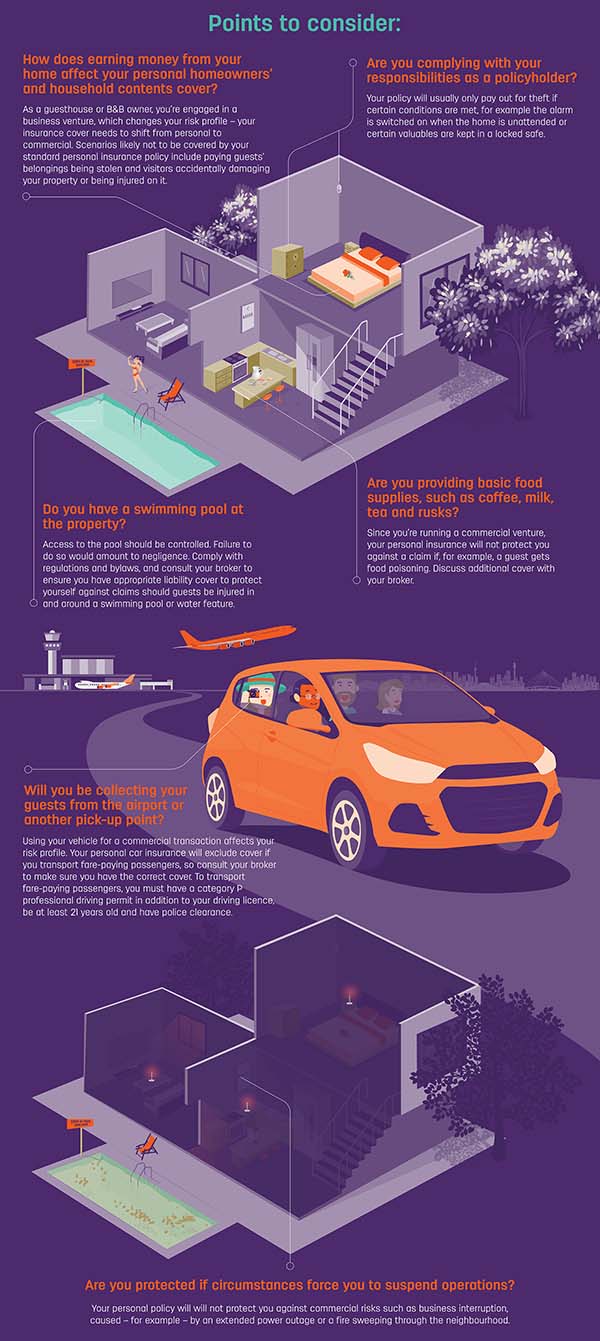

Bear in mind, though, that exclusions will apply when you rent out your property or have paying guests in your home because your commercial venture changes your risk profile.

Your requirements for public liability insurance will also differ from the liability cover included in your homeowners' policy.

What to do

- Take out tailored insurance for your particular needs – whether you own or run a guesthouse or a B&B, operate an Airbnb or rent out rooms in your home. Consult your broker to ensure you choose the best option, including cover for your and your guests’ belongings, liability cover and protection against business interruption losses.

- If you belong to a guesthouse or hospitality association, check if they offer any specialised options for cover. Airbnb, for example, has built-in host protection insurance against liability claims up to a certain amount.

Steps to take

- Carefully check your existing insurance policy to make sure what the requirements are when listing your home as a guesthouse or opening a B&B.

- Make sure you understand all your responsibilities and liabilities. The onus is on you to make sure there are no risks to your guests, such as a loose tile or broken step.

- Take out additional cover for accidental damage to household contents, and additional liability cover.

- Put up disclaimer notices in clear language that guests will be able to see and read them. Also, have disclaimer clauses in your agreements. Consult an attorney if you are not sure how to word these.

The bottom line

Insuring your guesthouse with a specialist policy for bed and breakfast and guesthouse operators is a must.

Are you following us on Twitter and LinkedIn for real-time updates?